Is there a right way to invest? Not really. Each person has their own style, but what ultimately matters are the results. This is especially true in the realm of investing, where even the most successful stock pickers on Wall Street employ a variety of strategies to achieve their goals. And what are these goals? Big returns, of course.

Take billionaires Steve Cohen and Ken Griffin, for example. Both had incredible careers, but each’s path to wealth was distinct. Griffin, who runs hedge fund Citadel, adheres to quantitative investment methods, while Cohen, who runs asset management firm Point72, is famous for his high-risk/high-reward strategy.

That doesn’t mean their stock picks never intersect. In fact, some specific stocks are part of everyone’s respective portfolios. And if two investment gurus are strongly attached to the same names, it’s natural for investors to be curious as to why they are both investing.

With that in mind, we used the TipRanks database to find out if two stocks billionaires have recently added to their funds represent compelling play. According to the platform, the analyst community thinks so, with both picks earning consensus “Strong Buy” ratings. Let’s check the details.

Humana inc. (hum)

Uncertain times make the healthcare segment an ideal destination, as the sector is seen as a sector boasting defensive qualities that can withstand any difficult macroeconomic developments. So it’s no surprise to find both Cohen and Griffin invested in Humana, an American healthcare giant and one of the leading providers of health insurance plans and related services.

The Louisville, Kentucky-based company is one of the largest managed care organizations in the United States, offering a wide range of health insurance products, including individual and group plans, Medicare Advantage and plans prescription drugs. Humana serves millions of customers and boasts a market capitalization of over $64 billion.

Such a value proposition helped the company compose a strong Q1 report. Revenue rose 11.6% year-over-year to $26.74 billion, beating the forecast of $340 million. Likewise on the bottom line, adj. EPS of $9.38 beat the $9.20 expected by analysts. Humana also reaffirmed its target for individual Medicare Advantage (MA) membership growth in 2023 of no less than 775,000, a 17% increase from the end of fiscal year 2022 memberships, while outpacing growth. Of the industry.

As for VIP involvement, in the first quarter Griffin increased its stake in HUM by 2,216% with the purchase of 973,754 shares. In total, he now owns 1,017,699 shares, with a current value of $522.4 million. During the same period, Cohen opened a new position by acquiring 189,079 shares of HUM, which currently hold a market value of $97 million.

Reflecting the confidence of these investor heavyweights, Morgan Stanley’s Michael Ha stresses that the company’s growth expectations are key to its investment thesis.

“Amid recent growing investor concern over 2024 MA growth, we view mgmt’s comment very favorably,” Ha said. “Management believes Humana can grow ‘at or above HSD’ Individual Medicare Advantage in 2024 – We believe so too and continue to view Humana as having the strongest multi-year earnings growth in Managed Care.”

These comments underpin Ha’s overweight (buy) rating, while his price target of $637 suggests the stock will post 24% year-over-year growth. (To see Ha’s track record, Click here)

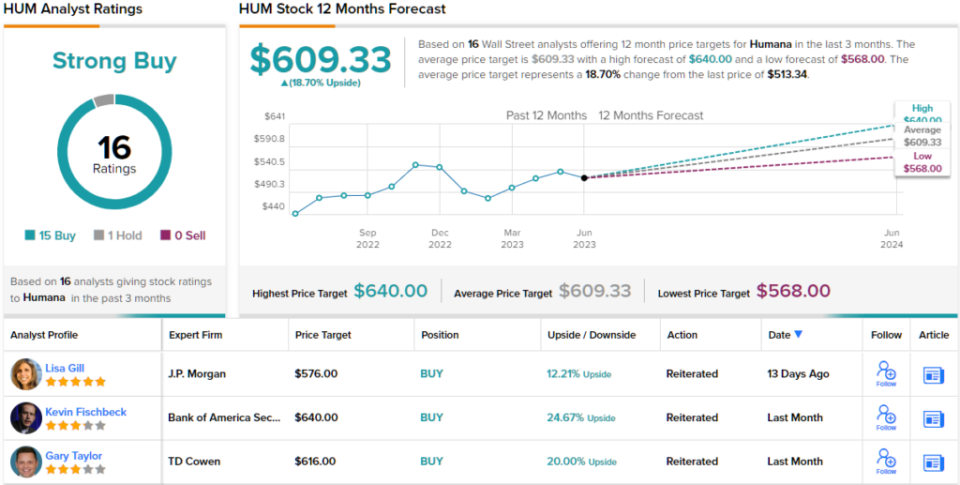

The rest of the street agree almost unanimously. Aside from a close, the other 15 recent analyst reviews are positive, making the consensus here a strong buy. Passing through the average target of $609.33, in one year the stock will change hands for a premium of around 19%. (See HUM Inventory Forecast)

Cousins Properties (CUZ)

Another way to hedge against macroeconomic uncertainty is to invest in real estate investment trusts (REITs), a defensive segment known for its hefty dividends. The next Cohen/Griffin-backed name in the spotlight here is Cousins Properties.

With a history dating back to 1958, this REIT has established itself as a leading owner, operator and developer of high quality office properties. Cousins Properties is primarily focused on the acquisition, development and management of Class A office properties in major markets in the Sunbelt region. The company’s portfolio includes a diverse range of assets, including corporate headquarters, urban office towers and suburban office parks.

While some have sounded the alarm about the precarious state of the U.S. commercial real estate market, that hasn’t stopped Cousins from delivering a strong statement in the latest quarterly report – for 1Q23. Revenue hit $202.73 million, which was an 8.5% year-over-year increase while beating tipsters’ forecast of $7.64 million. At the other end of the scale, the company dialed in an FFO of $0.65, beating the consensus estimate of $0.63.

Cousins also pays a regular dividend. The current payment is $0.32 and earns an inflation rate of 6.46%.

All of this must be attractive to Cohen and Griffin. As for their involvement, Cohen pulled the trigger on the stock, buying 1,071,615 shares worth more than $23.1 million at the current stock price, while Griffin took an even stance. larger, by purchasing 3,257,081 shares. The move brought his total stake size to 3,295,280 shares, with the value reaching an impressive $71 million.

The headline also impressed Baird analyst Wes Golladay, who believes that CUZ appears “well positioned to maneuver the macroeconomic headwinds currently facing the sector.”

“CUZ’s late-stage leasing pipeline doubled during the quarter to 700ksf, including some activity at its Neuhoff development in Nashville,” Golladay wrote after scanning the first quarter printout. “This pipeline, along with 480 ksf of signed agreements that have not yet started this year, will help increase occupancy throughout the year. Additionally, CUZ’s balance sheet provides the company with the flexibility to take advantage of price shocks in the market and grow its Sun Belt trophy portfolio.

To that end, Golladay notes that CUZ shares an outperformance (i.e. a buy) supported by a price target of $27. If the figure is reached, in a year investors will be sitting on 25% returns. (To see Thillman’s track record, Click here)

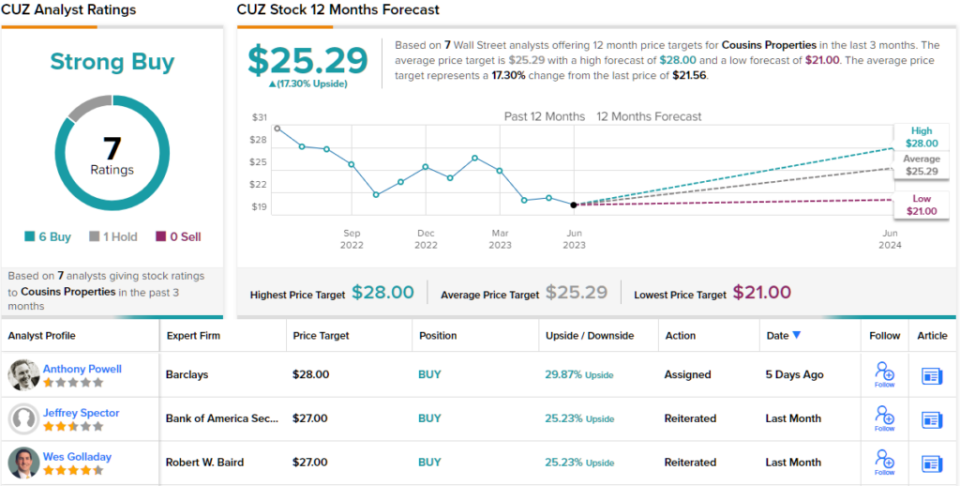

In total, CUZ has garnered 7 analyst ratings over the past few months, with 6 buys and 1 hold, making it a Strong Buy consensus rating. The stock’s $25.29 mid-price target suggests it has a 17% upside from the current trading price of $21.56. (See CUZ Stock Forecast)

To find great stock trading ideas at attractive valuations, visit TipRanks’ Best Stocks to Buy, a recently launched tool that brings together all of TipRanks’ stock information.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.