David Einhorn’s hedge fund Greenlight Capital posted big gains in 2022, being one of the few to benefit from last year’s bear market. Conditions suited the value style of investing and the fund had its best year in a decade. However, the situation has been different so far this year as Greenlight has underperformed the major markets.

Einhorn, however, isn’t about to bang his head against the wall and try to fit a square into a circle. In a recent letter to shareholders, he said: “Many said what worked in 2022 didn’t work in early 2023, and vice versa. That seems about right to us.

As economy sends mixed signals – jobs, wages and household balance sheets appear ‘pretty strong’ amid fears that tighter lending standards will ‘constrain the economy and create a substantial downturn’ – Einhorn remains responsive to the direction the wind is blowing. “Our net long exposure is now back in line with its long-term average,” he said. “We are also open minded to getting even sharper or back down as economic events unfold.”

Meanwhile, Einhorn has doubled down on stocks he believes will do well regardless of the economic backdrop and among those are a pair of under-the-radar energy stocks. We scoured these tickers in the TipRanks database to find out what Wall Street stock experts think about them. Let’s check the results.

Gulfport Energy Corporation (GPOR)

The energy sector was one of the few segments to shine in 2022, and while Einhorn is open to new ideas, it still seems like he’s betting his luck. He loaded up on shares of Gulfport Energy Corporation, an Oklahoma City-based independent oil and natural gas exploration and production (E&P) company.

With operations primarily focused on the Appalachian and Anadarko Basins, the Company engages in the acquisition, development and production of oil and gas reserves. Gulfport has a portfolio that includes both conventional and unconventional assets, with particular emphasis on shale formations such as Utica Shale in Ohio and the SCOOP play in Oklahoma.

The firm adheres to a disciplined approach to capital allocation, prioritizing high-quality assets with favorable risk-reward profiles. It’s a strategy that has helped Gulfport deliver a strong set of results in the last reported quarter – for 1Q23.

During the quarter, revenue increased 5% year-on-year to $1.05 billion. The company exceeded expectations with a total production of 1,057.4 MMcfe (million cubic feet of gas equivalent) per day. Gulfport posted net income of $523.1 million and adjusted EBITDA of $229.7 million, beating consensus estimates. Additionally, the company generated $63.1 million in adjusted free cash flow.

The market reacted well to the results, and most likely Einhorn too. In the first quarter, he increased his stake in GPOR by 126% with the purchase of 157,500 shares. He now owns a total of 283,000 shares, with a current value of $28.26 million.

5-star Truist analyst Neal Dingmann is also a fan and thinks the company has some differentiating attributes.

“Gulfport has a number of variables that stand out from most other small-cap gas E&Ps, resulting in continued and notable FCF generation despite low natural gas prices. The company’s minimal/maintenance capital will drive production growth in a program that should benefit from operational efficiencies and lower OFS costs, while having nearly all production covered this year and beyond by 60% next year to + $3/mcf. Low existing debt allows GPOR to distribute most of the FCF back to shareholders in the form of large share buybacks,” Dingmann said.

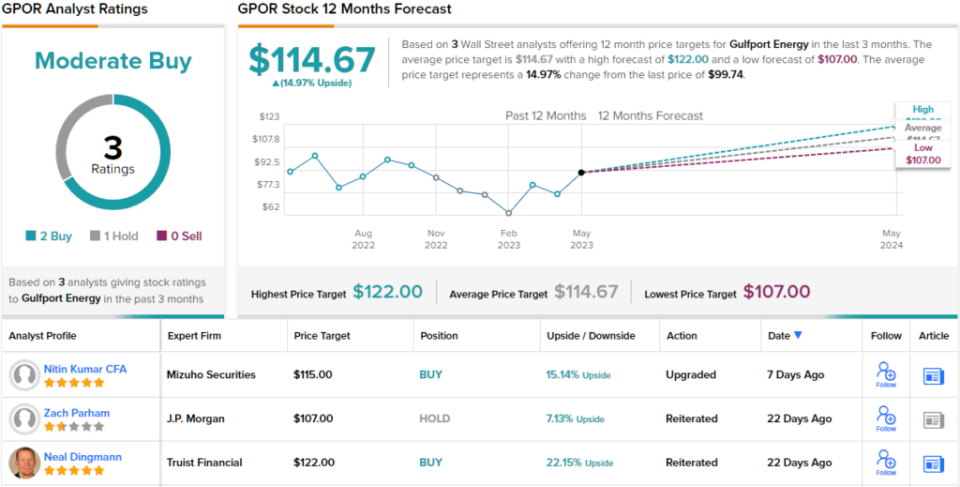

Putting these thoughts into the notes and numbers, Dingmann views GPOR as a buy while its price target of $122 suggests the stock will climb 22% over the next few months. (To see Dingmann’s track record, click here)

Elsewhere down the street, this under-the-radar name receives 1 additional buy and hold, each, all merged to a moderate buy consensus rating. Based on the average target of $114.67, stocks have room for growth of around 15% over the coming year. (See GPOR Inventory Forecast)

CONSOL Energy (CEIX)

The next Einhorn-approved name we’ll dig into is CONSOL Energy, a major US coal producer and exporter. With active mining operations dating back to 1864, the company has a diverse portfolio of coal assets, encompassing both underground and surface mining operations.

Its flagship operation is the Pennsylvania Mining Complex, which has the capacity to produce approximately 28.5 million tons of coal per year. The complex consists of three large-scale underground mines: the Bailey Mine, the Enlow Fork Mine and the Harvey Mine. Additionally, the company has a full export terminal in Baltimore. In fact, given the expected decline in coal consumption in the United States, CONSOL Energy has focused overseas, making the export business increasingly important.

The company also benefited from Russia’s war on Ukraine, as Europe sought other sources of coal supplies rather than relying on coal exports from Russia. The latest set of quarterly results shows how CONSOL has been positively impacted.

First quarter GAAP net income reached $230.4 million, compared to a loss of $4.4 million posted in the same period last year, while adjusted EBITDA fell from $169.2 million. dollars a year ago to $346.3 million. On the revenue side, revenue grew 92.1% year-over-year to $688.6 million, while beating Street’s forecast of nearly $96 million .

Along with the quarterly results, CONSOL also announced its dividend payout, set at $1.10 per common share. This represented 17% of cash available for distribution. The $1.10 dividend annualizes to $4.40 per share and yields a high yield of 7.52%.

As for Einhorn, he must have been pleased with the results. In the first quarter, he purchased 904,190 shares, increasing his stake in the company by 50%. In total, he now owns 2,716,741 shares, representing a current market value of $158.41 million.

Einhorn is not the only bull on CONSOL. Nathan Martin, a 5-star analyst at Benchmark, is impressed with the company’s execution in recent months, writing, “CEIX is now almost fully contracted for 2023 and 60% committed and priced for 2024 based on our estimates, providing improved cash flow. visibility. Moreover, it has almost achieved its debt reduction goals. As such, the company has increased its shareholder return program to 75% of FCF and increased its repurchase authorization to $1 billion, as it plans to move to repurchases.

These comments underpin Martin’s Buy rating, while his $80 price target implies investors will pocket returns of around 39% a year from now. (To see Martin’s track record, click here)

CEIX definitely fits the description under the radar. Martin is currently the only analyst to have published a review of the company’s outlook over the past 3 months. (See CEIX Stock Forecast)

To find great stock trading ideas at attractive valuations, visit TipRanks’ Best Stocks to Buy, a recently launched tool that brings together all of TipRanks’ stock information.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The Content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.