-

According to Bank of America, there is still some upside in stocks after the start of a new bull market on Thursday.

-

“After crossing the +20% mark from the bottom, the S&P 500 continued to rise over the next 12 months 92% of the time,” BofA said.

-

These are five questions investors should be asking themselves now that the bear market is officially over, according to BofA.

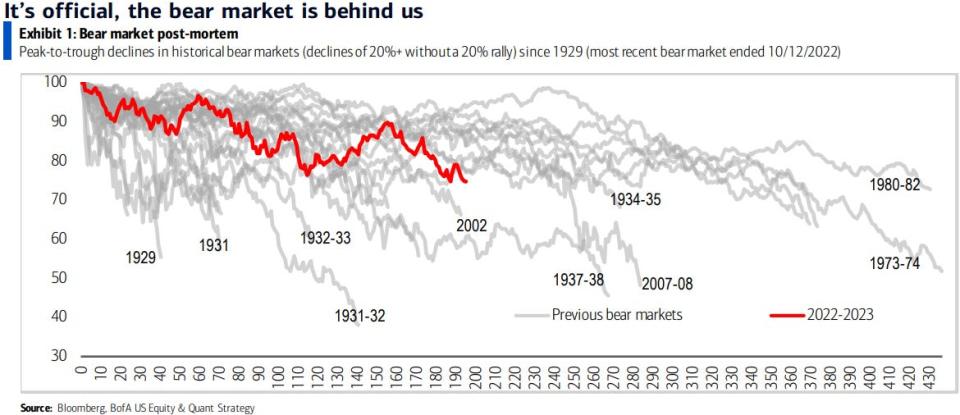

The bear market in equities is officially over and a new bullish regime has begun after the S&P 500 closed 20% above its Oct. 12 closing low on Thursday.

And according to a Friday note from Bank of America equity strategist Savita Subramanian, stock market gains could continue as investors slowly buy into the bullish environment and macro headwinds like rising interest rates that are nearing their end.

Additionally, stocks are doing well after the 20% bull market threshold is reached, based on historical data.

“We don’t place much weight (pun intended) on arbitrary definitions, but note that after crossing the +20% mark from the bottom, the S&P 500 has continued to rise in the 12 months. following 92% of the time, returning 19% on average,” Subramanian said.

This is based on data from the 1950s and is compared to a 12-month success rate of just 75% and an average overall 12-month return of 9%.

While there are still risks to the rally, the stock market has a way to continue climbing a wall of worry as investors stay on the sidelines due to negative sentiment and lingering concerns. But now is the time for investors to prepare for a new bull run and to start asking questions to prepare.

These are the five things investors should ask now that the bear market is officially over and a new bull regime has begun, according to BofA.

1. “What will it take for investors to become optimistic again?”

“The wall of worry could continue until investors feel pain in long bonds or FOMO in equities. Investors bought a singular equity theme (IA, more below) but a A broader bullish argument for equities can be made: we are out of ZIRP and real yields are positive again, volatility around rates and inflation has eased, earnings uncertainty has diminished and Companies have preserved margins by cutting costs and focusing on efficiency After a rapid up cycle, the Fed has room to relax Equity risk premium could autumn from here,” Subramanian said.

2. “Should I invest in actively managed funds?”

“After decades of passive equity funds taking stakes in assets, the active approach in public equities now makes sense. Fewer eyes means inefficient markets (more alpha), higher dispersion and a reversal of passive flows argue for stock picking over indexing Index primacy this year from record thinness is unsustainable,” Subramanian said.

3. “Which equity index, equally weighted or weighted cap?”

The equally weighted S&P 500 could generate double the returns of the S&P 500 based on various signals. These include range reversion, relative value (the equally-weighted index trades at 15x), lower duration risk compared to the capitalization-weighted index, and potential higher relative to the cap-weighted index based on our analysts’ price targets,” Subramanian said.

4. “If stocks are reviled, why is the S&P 500 trading at 20x?”

“Wall Street is plagued by half-hearted bears, and individual investor exits are at capitulation levels somewhat at odds with high instant multiples. 20x is not the reason to be bearish – when earnings fall like they are today, the P/E ratios are going up. It’s just math,” Subramanian said.

5. “How can I make money with AI?”

“The obvious beneficiaries, the capex takers, are semis and some software companies that can provide AI services. But not all technologies win, many have to spend just to stay competitive. The biggest benefit may be obtained by old-economy, inefficient businesses that can increase earning power more permanently through efficiency and productivity gains,” Subramanian said.

Read the original article on Business Insider